When the European Investment Bank (EIB) began offering venture debt in 2015, it was seen as a bold experiment in startup financing. A decade later, the scale and consistency of its investment tell a different story: venture debt isn’t a fringe product, it’s a foundational part of how European startups grow.

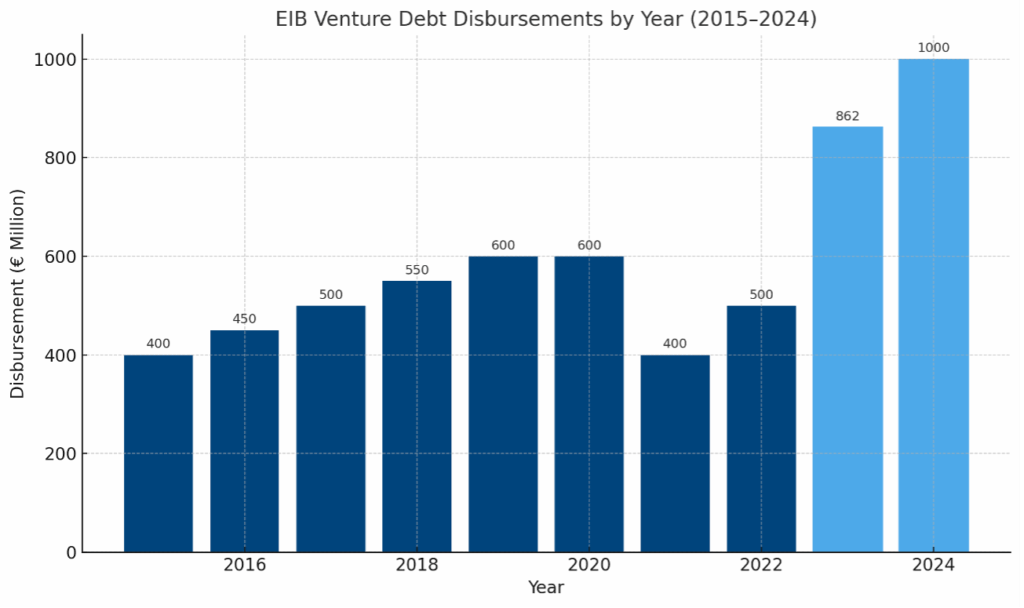

More than 200 companies have received EIB venture debt since the program’s inception, totaling more than €6 billion in deployed capital and contributing to over 50 successful exits. In 2024 alone, the EIB committed a record €1 billion in venture debt.

This isn’t just a European story—it’s a lesson for founders everywhere, especially in the U.S., where venture debt still isn’t as well understood or widely embraced. While American startups often treat debt as a last resort, their European counterparts have taken a more strategic approach to building capital stacks. And in today’s tighter funding environment, that mindset offers a clear advantage.

The EIB’s Venture Debt Model and What It Signals

EIB’s venture debt program was designed to bridge a well-known funding gap: the “valley of death” that often follows early-stage equity rounds but precedes meaningful revenue or late-stage VC interest. Structured as long-term loans with flexible repayment terms, EIB venture debt supports capital-intensive sectors like climate tech, deep tech, and life sciences—sectors where European startups have made significant strides in recent years.

The scale of the program speaks volumes. In 2023, the EIB disbursed €862 million in venture debt; the following year, it crossed the €1 billion mark, further proof that this is no longer a niche instrument. Backed by the EU and guided by a mission to strengthen innovation across the continent, the EIB is betting on debt as a lever for growth.

It’s doubling down on that bet: under its newly announced Tech EU initiative, the EIB plans to allocate €70 billion between 2025 and 2027—including €40 billion in loans, €20 billion in quasi-equity, and €10 billion in guarantees.

The European Perspective: Strategic, Not Defensive

European founders, often operating with more constrained funding options and fewer mega-rounds, have adapted by being more strategic. They understand that equity is expensive—and not always the right tool for every job. Venture debt is used proactively: to extend runway, bridge to milestones, or fund large capital expenditures (like equipment or infrastructure) that equity investors may hesitate to back.

As a result, venture debt has become normalized across European startups. There’s less stigma around debt, and more alignment between capital type and business need.

The U.S. Hesitation

In contrast, many U.S. startups still regard venture debt as a signal of weakness—a stopgap measure when equity financing falls through. That perception, while slowly evolving, continues to limit how founders think about capital strategy. Even as equity rounds take longer to close and valuations compress, some U.S. founders avoid debt entirely, leaving valuable financing options on the table.

This is especially ironic given how sophisticated the American venture ecosystem is in so many other respects. Non-bank lenders, equipment financiers, and venture debt specialists are widely available. But unless founders approach them early and with clear intent, they may miss the opportunity to use debt as a strategic advantage.

What U.S. Startups Can Learn

The lesson from Europe isn’t to replace equity with debt—it’s to think holistically about capital. Not every dollar needs to come from dilution. Used wisely, venture debt helps:

- Extend runway without giving up ownership

- Finance assets that generate revenue or operational efficiency

- De-risk the timing between funding milestones

- Preserve founder and early investor equity ahead of major valuation inflection points

The European Investment Bank has helped prove this out at scale. More than 200 companies have leveraged its venture debt program, many achieving successful exits as a result. The takeaway is clear: venture debt, when structured thoughtfully and aligned with company goals, creates flexibility and resilience.

Final Thought

If European startups have learned to treat debt as a tool—not a red flag—then perhaps it’s time more U.S. founders did the same. The funding climate in 2025 demands creativity, efficiency, and strategic capital planning. That doesn’t mean raising less money; it means raising smarter money.

Venture debt is not a last resort. It’s a sign of a founder who understands the full range of financial instruments available—and knows how to use them to build a stronger company.